February 6, 2024

The ARES ESG Award was created with the aim of promoting ESG initiatives undertaken by J-REITs, while also encouraging industry-wide collaboration by allowing J-REITs to learn from each other's initiatives. What sets this award apart from other ESG awards is its unique evaluation criteria, which include assessing the initiatives based on their creativity and ingenuity (uniqueness), as well as their potential for other J-REITs to adopt and implement (universality). The inaugural ARES ESG Award 2023 received numerous applications, signaling a renewed sense of unity and a heightened awareness of sustainability within the J-REITs industry. The winning initiatives demonstrated exceptional creativity and ingenuity, and it is hoped that other J-REITs will incorporate similar approaches into their future endeavors.

Furthermore, the ESG initiatives survey (see the PDF link "Summary of J-REITs ESG Initiatives Survey Results" below) highlighted extensive engagement by numerous J-REITs in advanced initiatives. Notably, robust efforts were evident in the environmental area, with over 90% of J-REITs actively addressing GHG emissions volumes and setting reduction targets. With growing social demand for ESG-focused initiatives, particularly in the environmental area, collaborative efforts within the J-REITs industry are expected to address emerging issues and complex challenges.

ARES ESG AWARD 2023 award presentation ceremony was held at the Association for Real Estate Securitization's 2024 New Year Reception on January 29, 2024, at the Imperial Hotel.

At the ceremony, the purpose of the ARES ESG AWARD was explained, and winning initiatives were introduced. Chairman Komoda presented the commemorative plaque to the asset management companies of the six investment corporations.

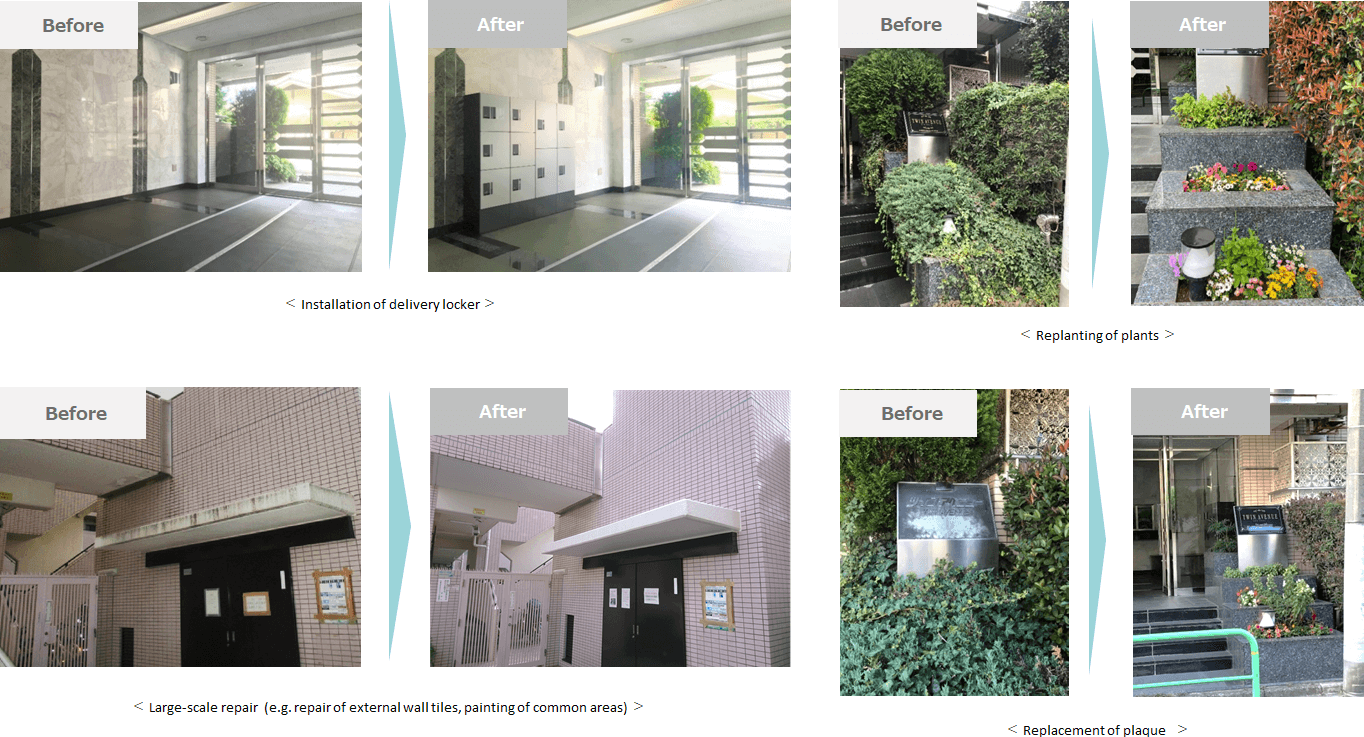

Tosei Reit Investment Corporation aims to improve profitability and reduce the environmental burden of properties that are over 30 years old by extending their useful life through appropriate repairs and equipment renewal and avoiding the scrap-and-build approach. For example, a leased condominium built 31 years ago in Nerima Ward, Tokyo, had a large-scale repair (repair of external wall tiles, replacement of sealing, painting of external walls, replacement of common area floors), installation of environmentally friendly water-efficient faucets, replacement of the plaque, improved design with replacement of plants, and enhanced convenience and comfort for tenants with installation of warm-water bidet seats and delivery lockers.

Many of the measures are general and simple to implement. By implementing ongoing improvements like these, the profitability of older properties can be improved while also contributing to ESG.

As a result, the building acquired three stars from DBJ Green Building Certification and secured funding through green financing as an eligible green asset.

Initiatives aimed at reducing embodied carbon have begun to emerge within the realm of GHG emissions reduction in the real estate sector. Within this context, an ambitious endeavor was undertaken to simultaneously enhance value and alleviate environmental impact through the renovation of an existing asset. This initiative involved extensive renovation aimed at improving the profitability of an older property, incorporating various enhancements such as the installation of water-efficient faucets (environmental), replacement of signage and landscaping (design), and the introduction of delivery lockers and heated bidet seats (convenience/comfort). These efforts not only expanded the environmental footprint of J-REITs towards a circular economy but also underscored their adaptability. The clear and successful pursuit of environmental certification serves as a commendable benchmark for other J-REITs to emulate.

ITOCHU REIT Management Co.,Ltd., the management company for Advanced Residence Investment Corporation, held a student competition seeking ideas for the renovation of a leased condominium in its portfolio to support students studying architecture and design by providing an opportunity to participate and encourage their interest in the company and the J-REITs industry. A renovation based on the winning design was implemented. Interviewing a real estate company with experience in holding competitions, selecting the competition committee chair, establishing the theme, and sending notices to the universities and specialist websites were all carried out internally.

The competition wasn't merely about soliciting ideas from students; it was conducted with the understanding that the construction based on the winning design would be implemented. It encompassed considerations such as target tenants, target rent, and the development of a "business plan," including estimates for construction costs. This made it a unique and complex competition, demanding practical proposals aligned with real-world requirements.

The competition was held only twice, partly due to the impact of the COVID-19 pandemic. Nonetheless, it served not only as a platform for student engagement but also promoted a shift in entrenched ideas on renovations among staff. Additionally, it facilitated broader access to students for recruitment purposes.

As the population declines, the imperative to cultivate promising young talent and secure resources is expected to become a pressing concern for both the J-REIT industry and the broader real estate sector. A distinctive initiative was launched, involving the engagement of architecture and design students in renovating leased condominiums within the portfolio, offering them valuable participation and learning opportunities. This initiative not only serves to attract top-tier talent for the asset management company but also presents a unique opportunity to foster greater interest in the industry among the younger generation. Furthermore, it represents an innovative approach to enhancing social value by integrating human capital development into business practices.

Tokyo Realty Investment Management, Inc., the asset management company for Japan Prime Realty Investment Corporation, prioritizes regulatory compliance and prevention of conflicts of interest while also emphasizing investor-oriented, fair, and transparent management practices. As part of this commitment, external experts have been invited to join the Sustainability Committee, Investment Policy Committee, Risk Management Committee, and Compliance Committee. Their specialist knowledge and expertise are leveraged to strengthen the oversight function and to ensure transparency in decision-making processes. It aims to foster trust from the stakeholders and strengthen governance, ultimately leading to our sustainable growth.

In particular, the participation of the external advisor in the Sustainability Committee has enabled confirmation of the direction and appropriateness of the initiatives for promoting GHG emissions reduction and diversity. This has led to the effective incorporation of the demands and intents of external stakeholders. Furthermore, this has allowed the Committee members to acquire knowledge of global perspectives and the latest trends and contributed to employee literacy by providing employee feedback.

This initiative introduced external expert knowledge, bolstered oversight functions, and ensured transparent decision-making by involving outside experts across various committees. It has profound ramifications for considering sustainable governance within J-REIT management. While engaging external experts may appear straightforward, its execution demands considerable effort. We commend the successful implementation across multiple committees. The ability to promptly respond to swiftly developing situations and diverse stakeholder perspectives is paramount for sustainability endeavors. From this standpoint, it stands as a highly impactful measure.

ORIX JREIT Inc. ("OJR")'s asset management company, ORIX Asset Management Corporation ("OAM"), engaged in analyzing the identification of risks and opportunities that climate change presents to OJR and how these factors will affect future strategy and planning. Specifically, OAM is analyzing how resilient OJR's climate change measures are to the transition to a low-carbon economy in accordance with the Paris Agreement and physical risks, which are expected to increase, through qualitative and quantitative analysis in several scenarios based on TCFD recommendations (1.5-2℃ scenario and 4℃ scenario). In addition, OAM is working on verification by tools such as CRREM and CVaR, and working to create a transition plan aimed at "net zero by 2050". Moreover, OAM held a stakeholder meeting with ESG experts to explain the draft of the transition plan and receive feedback.

Information disclosure is comprehensive and concise, including "Business Impact of Climate Change" and "Impact of Risks and Opportunities on Earnings" under the TCFD Scenario Analysis.

OJR/OAM actively promote the visualization of environmental value utilizing the TCFD framework, conducting comprehensive TCFD analyses. The profound insights gained from these analyses have the potential to shape future real estate values, offering a sophisticated example that extends beyond individual portfolios to the broader real estate landscape throughout Japan. Moreover, the approach of emphasizing comparability through quantification rather than just qualitative description as well as the incorporation of external perspectives via the stakeholder meeting can be highly evaluated as a valuable case study for other J-REITs. While it may seem advanced at present, this approach can potentially become the standard practice in the real estate industry in the near future.

Hoshino Resorts REIT, Inc. ("HRR") believes maximizing investor value through ESG-conscious investment and asset management is essential to improve HRR's sustainability. Based on this belief, HRR has established the Sustainability Finance Framework and raised funds solely to use for purposes that improves the environment and have social benefits.

More specifically, facilities are assessed not only from environmental perspectives but also from social perspectives. On the "Sustainability" section of our website, the "social eligibility criteria" are categorized into "initiatives for related parties, including users of real estate" and "initiatives for local communities." The two categories comprise twelve social issues, such as "healthy living and workstyle" and "local charm and rich economy," with the stages of each social issue stated along with the initiatives' output, outcome, and impact. Use of the funds is limited to these purposes. The "Social issues" and "Stages of social issues" are set in accordance with the "Interim Summary of the ESG Investment Promotion Study Group Addressing Social Issues in the Real Estate Sector" (the Ministry of Land, Infrastructure, Transport and Tourism). Furthermore, as the impact reporting, properties that satisfy the social and green eligibility criteria for uses of funds are disclosed together with their output and outcome.

Assessment of the "S (social)" aspect of ESG in real estate investment is a complex theme involving numerous issues deserving thorough examination. HRR effectively leverages its asset attributes, focusing on the circular approach and the role of accommodation facilities in the local community. This initiative extends beyond conventional real estate parameters, comprehensively reviewing the broad social impact on society, local communities, and people. Moreover, HRR's establishment of social criteria linked to financing is groundbreaking in reevaluating social impact. It serves as a commendable model for J-REITs, particularly given their interconnectedness with respective local communities.

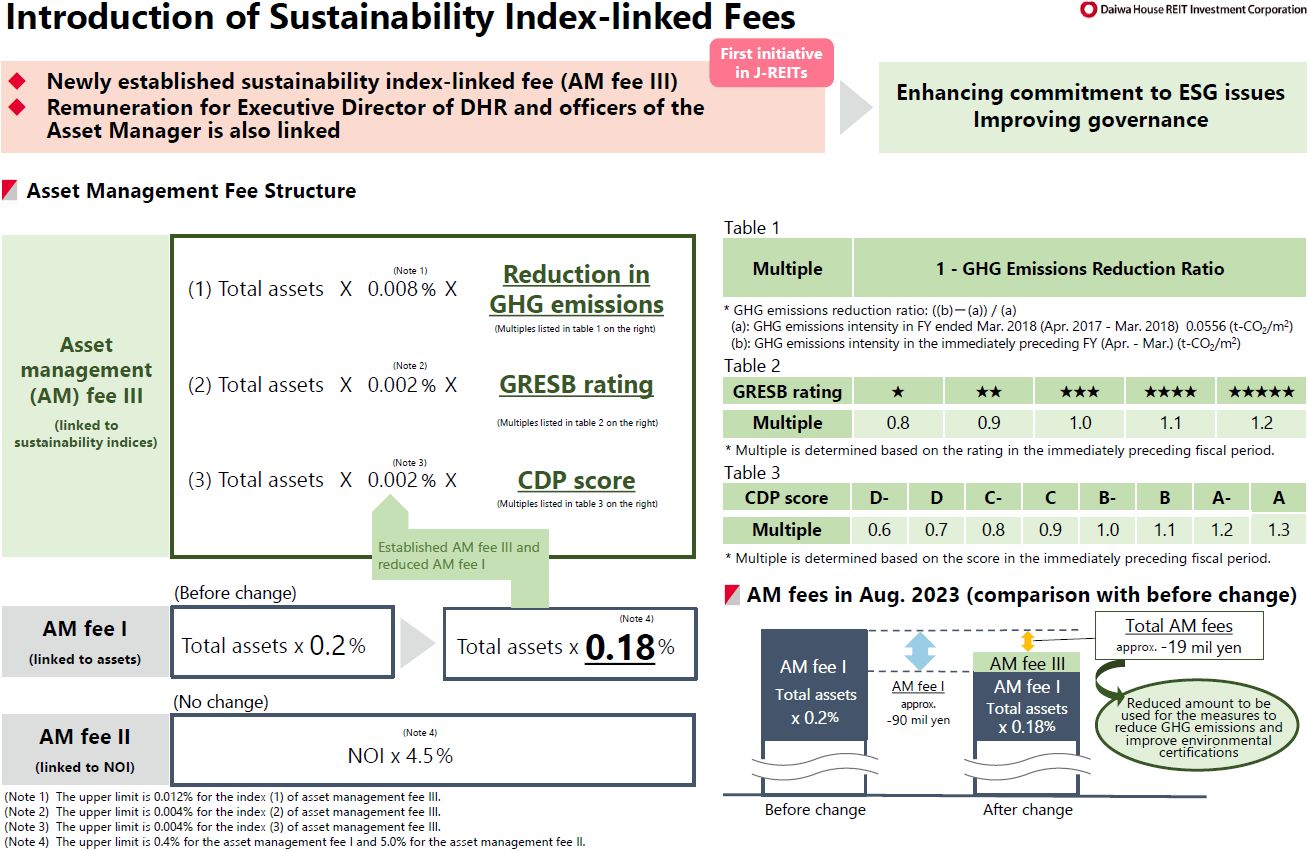

In 2021, Daiwa House REIT Investment Corporation ("DHR") introduced a provision to fluctuate the amount of asset management fees to the Asset Manager in conjunction with the sustainability indices, in addition to the existing asset-linked and profit-linked approach, as the first initiative in J-REITs to increase unitholder value by encouraging the reduction of GHG emissions of DHR properties and enhancing the external evaluations of its sustainability initiatives. The sustainability index-linked fees are calculated based on the sum of the indexed GHG emissions reduction ratio, GRESB Rating, and CDP Score multiplied by the total assets of DHR and are aimed at strengthening the commitment to solving ESG issues and improving governance.

Furthermore, remuneration for the Executive Director of DHR and remuneration for directors of the Asset Manager are now linked to sustainability indices, including GHG emissions reduction ratio, GRESB Rating, and CDP Score.

This ambitious initiative was the first among J-REITs to link the asset management fees paid to the Asset Manager to the sustainability index. It is an effective initiative in expanding and establishing ESG investment through the investment chain, using clear indices such as the GHG emissions reduction ratio, GRESB Rating, and CDP Score. The proactive involvement of senior management is pivotal for sustainability strategies, exemplified by their unwavering commitment in this instance. Introducing sustainability index-linked fees necessitates various practical measures; we have high expectations for its successful implementation.

Comment by the judges

In 2001, the inception of J-REITs opened avenues for both individual and institutional investors to engage in real estate investment via listed investment units, rather than direct property ownership. It has been pivotal in expanding the market. Increasing focus on non-financial values with the growth of ESG investments has spread to the J-REITs industry, and its initiatives have led to rapid improvements in environmental considerations within Japanese real estate and the enhancement of tenants' working environments. As frontrunners in ESG investment, J-REITs will be expected to continue driving the Japanese market. The introduction of the ARES ESG Award is both timely and aligned with these expectations. Additionally, the J-REITs industry thrives on a culture of mutual enhancement through information exchange, making this award a significant contributor to sectoral growth.

In the "Summary of J-REITs ESG Initiatives Survey Results" (see the PDF link below), it is evident that all applicants wholeheartedly promoted conscientious initiatives despite resource constraints. Particularly noteworthy were the environmental initiatives. As we advance, further improvement of real estate value can be expected through broader considerations of social initiatives, extending beyond employee and tenant satisfaction to generate a positive social impact for local communities and stakeholders at large. Governance, too, presents ample room for improvement, with a deeper analysis of investor expectations regarding J-REITs governance practices.